The landscape of accounting is changing dramatically, shifting from manual processes to innovative technology. Gone are the days of tedious data entry and endless spreadsheets. Automation and advanced financial management tools are now at the forefront, enhancing efficiency and accuracy in financial management. This evolution allows businesses to make informed decisions through real-time insights, streamline operations, and maintain a competitive edge. As we delve into the journey from traditional accounting practices to modern solutions, we’ll explore the benefits of embracing automation and how it’s revolutionizing financial management. Join us in discovering the exciting future of accounting!

From Old School to High Tech

The world of accounting, which used to involve lots of paperwork, manual math, and endless spreadsheets, is undergoing a dramatic transformation. Technology is revolutionizing how businesses manage their finances. It brings a new level of efficiency, accuracy, and data-based decisions. This digital transformation is not just about keeping up with the times; it's about embracing innovation to unlock new possibilities, streamline operations, and gain a competitive edge in a rapidly evolving business landscape.

From Spreadsheets to Smart Systems: A Journey of Evolution

Imagine a time when accountants spent countless hours meticulously entering data into ledgers, balancing books, and meticulously reconciling bank statements. This was the reality for many businesses just a few decades ago. While this manual approach could be accurate when executed properly, it was time-consuming, prone to errors, and limited in its ability to provide real-time insights into financial performance.

The evolution of technology began to disrupt this traditional paradigm, ushering in a new era of automation and digital transformation. The introduction of accounting software marked a significant turning point, replacing manual tasks with automated processes and offering greater efficiency and accuracy.

Let’s take a look at how accounting has changed over the years:

- Back in the Day: Imagine accountants spending hours and hours filling in ledgers by hand, reconciling bank statements, and making sure everything adds up. That’s how it used to be not so long ago. This old-school method was accurate if done right but was slow and prone to mistakes. Plus, it didn’t give you instant updates on how your finances were doing.

- The Tech Revolution Begins: In the 1970s, things started to change when the first accounting software came into play. These early programs were mainly for big companies and helped automate basic stuff like making invoices, tracking expenses, and doing simple reports. It was a big deal back then, but these tools were quite basic compared to what we have now.

- Personal Computers and Spreadsheets: Then came the 1980s with personal computers and spreadsheet software like Lotus 1-2-3 and Microsoft Excel. These were game-changers! Businesses could now manage their financial data much better, perform complex calculations, and make detailed reports. Spreadsheets became very popular, making the old paper ledgers look pretty outdated.

- Cloud-Based Accounting Software: In the late 1990s and early 2000s, the internet and cloud computing arrived, and things changed again. Cloud-based accounting software like QuickBooks Online, Xero, and Zoho Books became popular. These tools let businesses access their financial info from anywhere, anytime, and keep everything updated in real-time. It was like having a powerful accounting tool right at your fingertips.

- AI and Machine Learning: Nowadays, AI and machine learning are making a huge impact on accounting. AI tools can now automate many tasks, analyze lots of data, and even spot trends. This means accountants can focus on more important things like planning and strategy while AI handles the repetitive stuff.

Why Automation Matters: Addressing the Challenges of Traditional Accounting

While these technological advancements brought significant improvements to accounting practices, businesses still faced a range of challenges:

- Time-Consuming Manual Work: Businesses spent countless hours on data entry, reconciliation, and reporting, diverting valuable time and resources from strategic initiatives.

“According to a recent study by the Institute of Management Accountants, businesses waste an average of 20% of their annual operating expenses on redundant processes, including manual financial tasks.”

- Data Silos and Errors: Disconnected systems and manual data entry created inconsistencies and errors, leading to inaccurate financial reporting and potential compliance issues.

“A study by the American Institute of Certified Public Accountants (AICPA) found that 60% of businesses lack real-time visibility into their cash flow, making it challenging to manage finances effectively.”

- Limited Insights: Financial data was often delayed and difficult to analyze, making it challenging to gain actionable insights and make informed decisions. Businesses often struggle to track key financial metrics, identify trends, and make strategic adjustments based on their financial performance.

- Security Risks: Sensitive financial data is vulnerable to cyberattacks and breaches, threatening the security and reputation of businesses.

“According to IBM's 2022 Cost of a Data Breach Report, the average cost of a data breach for businesses reached a record high of $4.24 million.”

The Power of Automation: Transforming Accounting Practices

Technology is addressing these challenges head-on, offering powerful solutions to transform accounting practices and unlock a new era of efficiency, accuracy, and insights. Here's how automation is reshaping financial operations:

- Streamlined Workflows: Accounting software automates tasks like invoice processing, bank reconciliation, and financial reporting, eliminating manual processes and reducing the risk of errors. This frees up time for accounting teams to focus on high-value activities like analysis, financial planning, and risk management.

“A study by the Association of International Certified Professional Accountants (AICPA & CIMA) found that accounting automation can reduce manual tasks by up to 80%, increasing efficiency and productivity.”

- Real-time Insights:

Cloud-based accounting software provides real-time data and insights, giving businesses a clear picture of their financial health and performance. This enables better decision-making, more effective resource allocation, and improved forecasting.

“Businesses that use real-time data and analytics report a 10-15% increase in revenue growth and a 10% reduction in operating costs.”

- Enhanced Security: Advanced security measures, including data encryption and access controls, protect sensitive financial data from unauthorized access and cyber threats.

“According to a recent report by the Ponemon Institute, 88% of organizations have experienced a data breach in the past year, highlighting the critical need for robust security measures.”

- Increased Compliance: Automated compliance checks and integrated tools help businesses stay up-to-date with tax and regulatory requirements, minimizing the risk of penalties and legal issues. Failing to comply with regulations can lead to significant financial penalties and reputational damage.

The Future is Here: Embracing the Power of Automation

The accounting landscape is evolving rapidly, and embracing automation is no longer optional. Businesses that leverage technology to streamline their financial operations will gain a significant competitive advantage. They will be able to:

- Boost Efficiency and Productivity: Reduce manual work by 20% and increase staff productivity by 15-20% through automation. This frees up valuable time for accountants to focus on strategic tasks and analysis, enhancing their overall contribution to the business.

- Enhance Accuracy and Data Integrity: Reduce errors by up to 80% with automated data entry and processing. This leads to more reliable financial data and more accurate reporting, supporting informed decision-making and reducing the risk of costly mistakes.

- Strengthen Security: Minimize the risk of data breaches and protect sensitive financial information by implementing robust security measures and encryption protocols. This builds trust with stakeholders and protects the business from potential reputational damage.

- Unlock Powerful Insights: Leverage data analytics to make smarter decisions and optimize financial performance. Real-time data and insights enable businesses to identify trends, anticipate risks, and adjust their strategies to achieve better outcomes.

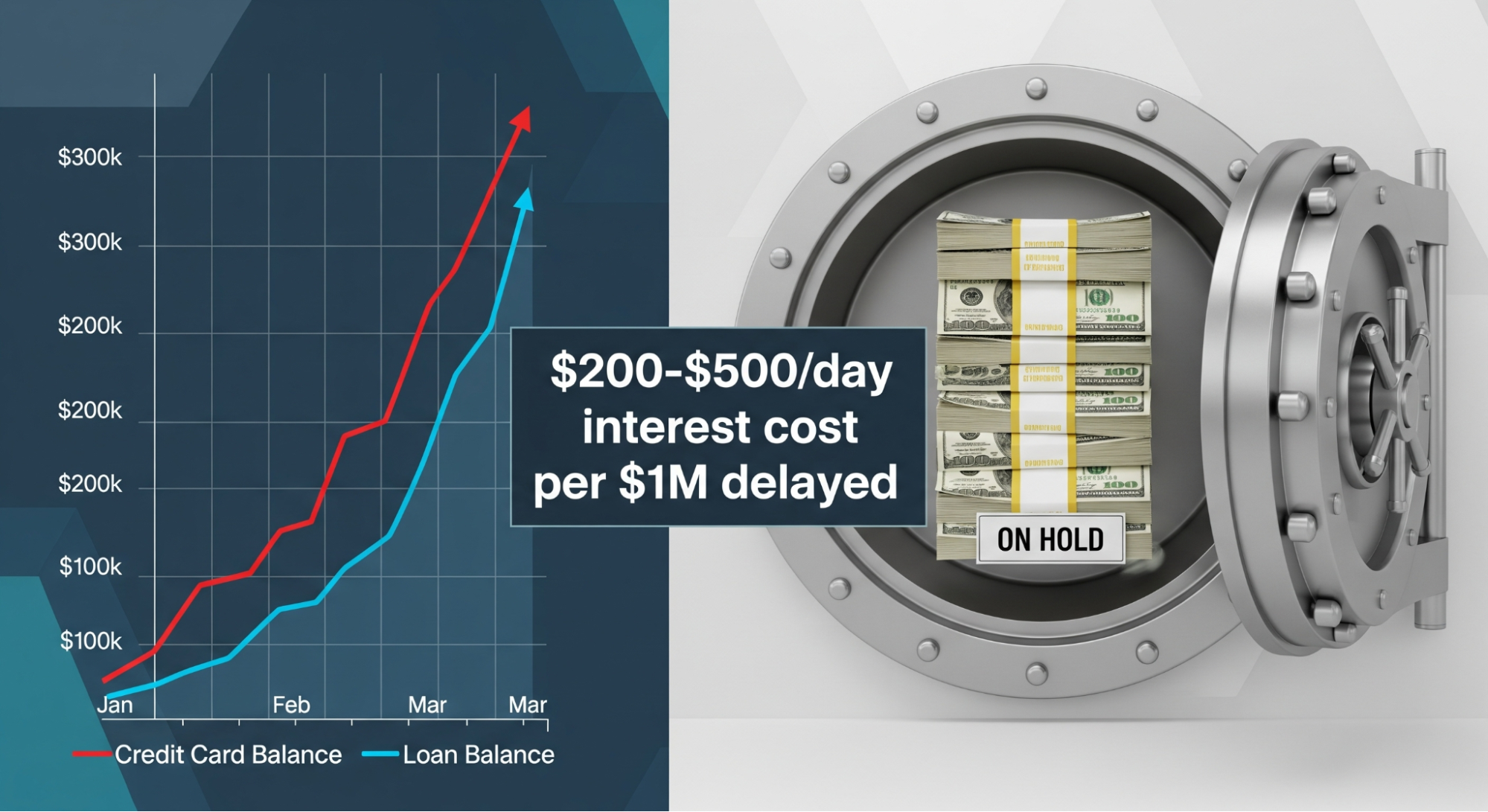

- Improve Cash Flow: Faster payment processing and streamlined financial management can lead to a 10-15% increase in revenue and a 10% reduction in operating costs. Improved cash flow allows businesses to invest in growth, manage expenses effectively, and seize opportunities when they arise.

A Look at the Future of Accounting: AI and Beyond

The future of accounting is likely to be even more transformative, driven by advancements in artificial intelligence (AI) and machine learning. AI-powered tools can automate complex tasks, analyze large amounts of data, and even predict future trends, making accounting processes even more efficient and insightful. Imagine:

- Automated Financial Reporting: AI can generate financial reports automatically, freeing up accountants to focus on analysis and interpretation.

- Predictive Analytics: AI can analyze historical data and identify potential financial risks and opportunities, helping businesses make more strategic decisions.

- Real-time Fraud Detection: AI algorithms can detect fraudulent transactions in real-time, reducing the risk of financial losses and improving security.

.jpg)

.avif)

.png)

.png)