Arjun Gupta

October 2, 2024

TABLE OF CONTENTS

Why wait when there are people eager to e-meet you?

Let's meet, greet, and discuss

Optimizing payment processes within Salesforce can streamline operations, enhance security, reduce errors, and significantly improve the customer experience. Salesforce, while not a payment processor itself, offers robust capabilities to integrate with various payment processors like Stripe, PayPal, Authorize.Net, and other comprehensive solutions such as REDA Pay. This integration empowers businesses to efficiently manage and automate payment transactions directly from their CRM platform.

“According to Statista, digital payments are projected to grow at a rate of 12.24% annually, with the total transaction value reaching approximately $11.29 trillion by 2026.”

In this blog, we will explore strategies for optimizing payment processing within Salesforce, including integration choices, automation, and leveraging tools like REDA Pay to enhance your payment workflows.

Before diving into optimization strategies, it's crucial to understand how payment processing operates within Salesforce. Essentially, Salesforce acts as the central hub for transaction data, allowing businesses to:

“A report by Deloitte noted that companies using automated payment systems have seen up to a 70% reduction in time spent on manual entry and human errors”

With a grasp on the fundamentals, let’s explore strategies to optimize payment processes within Salesforce:

1. Choose the Right Integration: Selecting the appropriate payment processor is crucial. Consider your business model, client needs, transaction volumes, and geographical operations. Salesforce AppExchange offers numerous pre-built solutions that simplify integration, minimizing the need for custom development and making it easier to manage payment data seamlessly within Salesforce.

2. Automate Processes: Automation is key to optimization. Use Salesforce's Flow or Process Builder to automate routine tasks like updating payment statuses, sending transaction alerts, or generating invoices. This reduces manual input, streamlines operations, and mitigates the risk of human error.

Set up recurring billing plans for subscription-based services to ensure timely, hassle-free transactions.

“According to MineralTree, businesses that adopt automated payment solutions can save upwards of $19 per invoice processed.”

3. Enhance Security and Compliance: Ensuring the security of payment data is non-negotiable. Here are some strategies:

4. Improve User Experience: A smooth user experience is crucial for both internal teams and customers:

5. Implement Error Handling and Logging: Implement comprehensive error handling within your payment processing workflows to capture and log transaction errors accurately. This facilitates quick troubleshooting and resolution.

Regularly monitor logs to proactively identify patterns or recurring issues that may need to be addressed.

When optimizing your payment processes within Salesforce, choosing the best payment processor from AppExchange is crucial. Among the various options available, REDA Pay stands out by offering unique features that enhance payment processing capabilities beyond what other processors provide:

Handling Inbound and Outbound Payments: REDA Pay stands out by processing both inbound and outbound payments, providing a comprehensive payment solution that many other processors do not offer.

Unique Payment Settlement Features: Unlike other processors, REDA Pay offers 24-hour payment settlement, allowing businesses to access their funds faster and streamline their financial operations significantly.

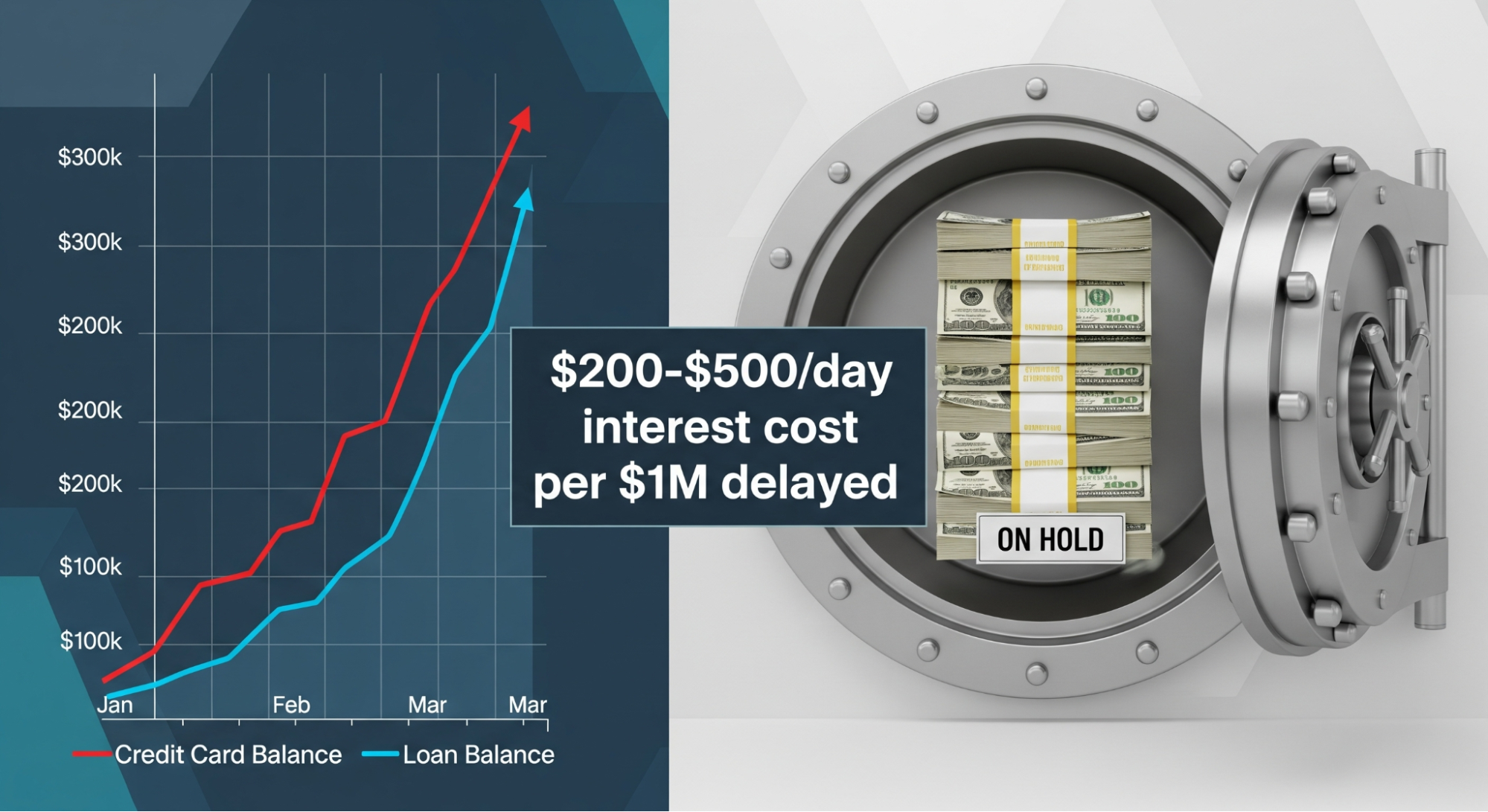

“According to a report by PYMNTS, 74% of CFOs reported that delays in payment processing could affect their company’s financial position.”

EMD Payments Management: REDA Pay supports the management of Earnest Money Deposits (EMD), a feature not commonly found in other payment processors. This can be particularly beneficial for industries that require secure handling of such deposits.

Flexible Fund Routing: REDA Pay offers flexible fund routing options, giving businesses the ability to tailor financial workflows according to their specific needs and ensuring smoother transaction handling.

Comprehensive Reporting: Harness advanced reporting features to gain deep insights into transaction histories and customer payment behaviors. With the capability to generate detailed reports, REDA Pay empowers businesses to analyze financial trends and make informed business decisions.

“Organizations that leverage data analytics in their payment processes can achieve a 5-10% improvement in working capital, as reported by McKinsey & Company.”

Enhanced Flexibility and Security: REDA Pay adapts to your business as it grows, efficiently handling increased transaction volumes while maintaining high security and compliance standards. This ensures that customer data is protected and business activities are seamless.

“A survey by Verizon in their 2023 Payment Security Report highlighted that only 27.9% of companies maintain full compliance with PCI-DSS standards, reflecting the ongoing challenges businesses face in securing payment data.”

Customer Experience and Flexibility: With an intuitive interface, REDA Pay allows businesses to offer multiple payment options to their customers, enhancing satisfaction and encouraging repeat business.

“According to a study by American Express, 86% of consumers are willing to pay more for a better customer experience.”

Choosing a solution like REDA Pay can transform payment processing within Salesforce, providing advanced features and unique capabilities that set it apart from other payment processors on AppExchange.

Finally, remember that optimization is an ongoing process. Regularly seek feedback from system users to identify potential bottlenecks or areas of improvement within your payment processing workflows. Use these insights for continuous iteration and enhancement of your processes.

Ensure your team is well-trained in using Salesforce payment features and REDA Pay functionalities. Ongoing training and support are essential to keep your staff up to date with the latest system enhancements, ensuring they can effectively manage transactions and serve your customers.

Optimizing payment processes within Salesforce is a strategic approach that can lead to significant operational improvements and a better customer experience. By integrating the right platforms, automating workflows, ensuring rigorous security standards, and continuously analyzing data, businesses can transform their Salesforce systems into powerful tools for managing payments effectively. Whether starting from scratch or refining existing processes, leveraging tools like REDA Pay can add an extra layer of efficiency, boosting both customer satisfaction and business performance.

.jpg)

.avif)

.png)

.png)