Arjun Gupta

September 3, 2025

TABLE OF CONTENTS

Why wait when there are people eager to e-meet you?

Let's meet, greet, and discuss

For U.S. property managers, every dollar of Net Operating Income (NOI) counts. NOI determines property valuations, keeps investors happy, and funds your growth plans. Yet across the industry, property managers are quietly bleeding NOI because of one persistent problem: late rent payments and broken reconciliation processes.

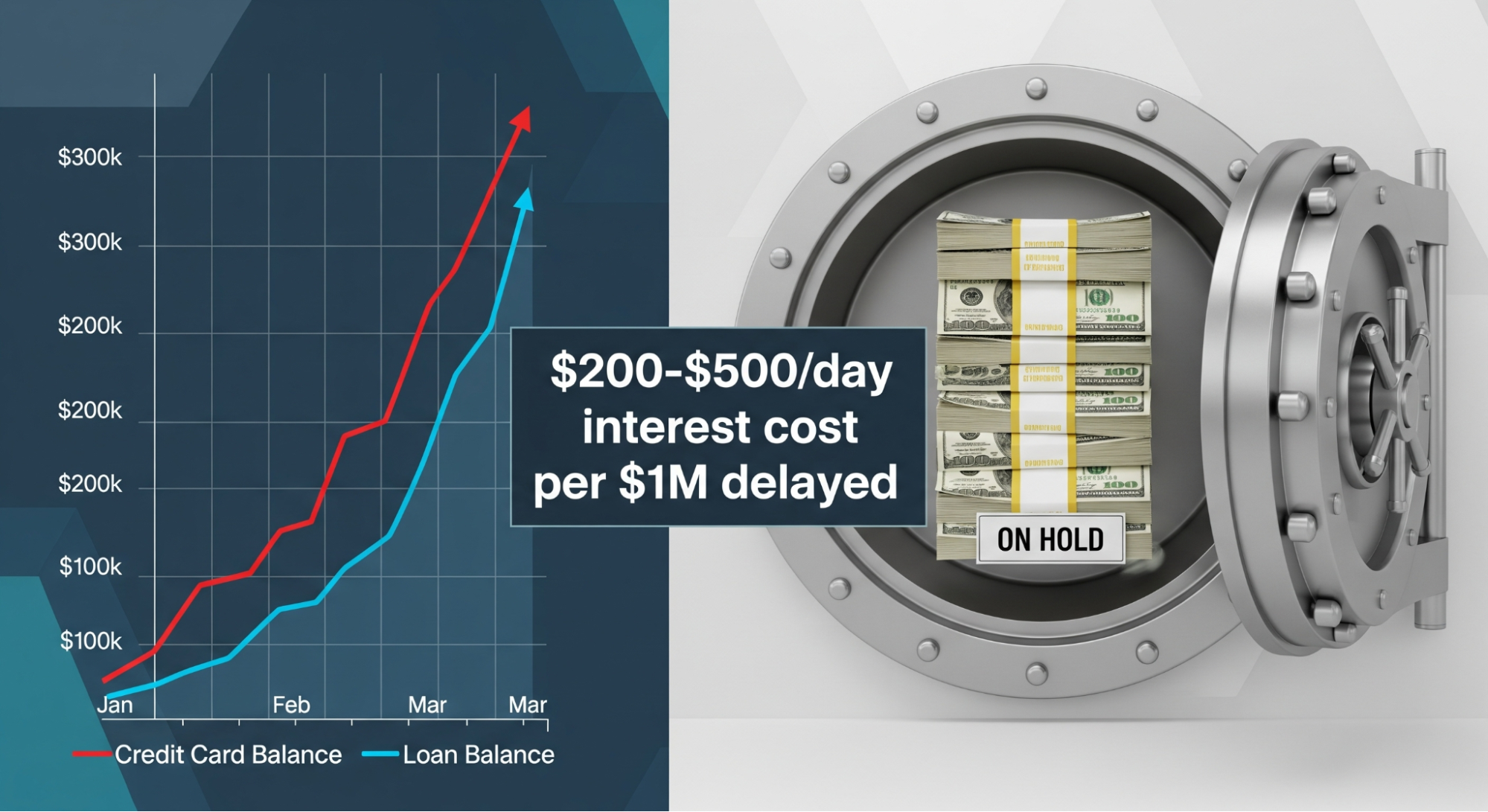

In today's market, with rising interest rates and insurance costs squeezing margins, even a 2-3% dent in NOI can mean the difference between hitting investor targets or scrambling to explain shortfalls. Unfortunately, the current U.S. payments infrastructure wasn't built for the speed property managers need.

After talking to dozens of property managers this year, the same frustrations come up repeatedly:

The Cash Flow Nightmare: Most tenants still pay rent through ACH transfers that take 3-5 business days to settle, or worse - checks that stretch payment timelines to weeks. A 2024 NMHC survey found that nearly 20% of renters pay late at least once quarterly, meaning entire portfolios operate with unpredictable liquidity.

The Administrative Time Drain: Buildium's 2023 Property Management Report shows property managers spend 8-12 hours per week per 100 units chasing late rent or reconciling partial payments. That's a full workday weekly lost to administrative busywork instead of growing your portfolio.

The Reconciliation Mess: Payments trickle in from everywhere - checks, ACH, wires, credit cards - turning month-end reconciliation into a spreadsheet nightmare. The Institute of Real Estate Management (IREM) identifies reconciliation delays as one of the top five operational inefficiencies driving NOI leakage.

The Bottom-Line Impact: A Deloitte study shows that late or missed rent can eat away 3-7% of NOI annually across multifamily portfolios. For a property generating $500K in annual rent, that's potentially $35,000 lost every year.

After working with property management companies nationwide, the solution requires three elements working together: speed, automation, and integration.

Most current solutions fall short:

Traditional Payment Processors like Chase or Bank of America offer basic ACH services but don't integrate with property management software. You're still manually matching payments to units and tenants.

Property Management Software Add-Ons from AppFolio or Yardi feel like afterthoughts. They work, but aren't built for speed and lack flexibility for custom portfolio workflows.

Third-Party Integrations create more problems than they solve. Data sync issues, security gaps, and constant system juggling make reconciliation harder, not easier.

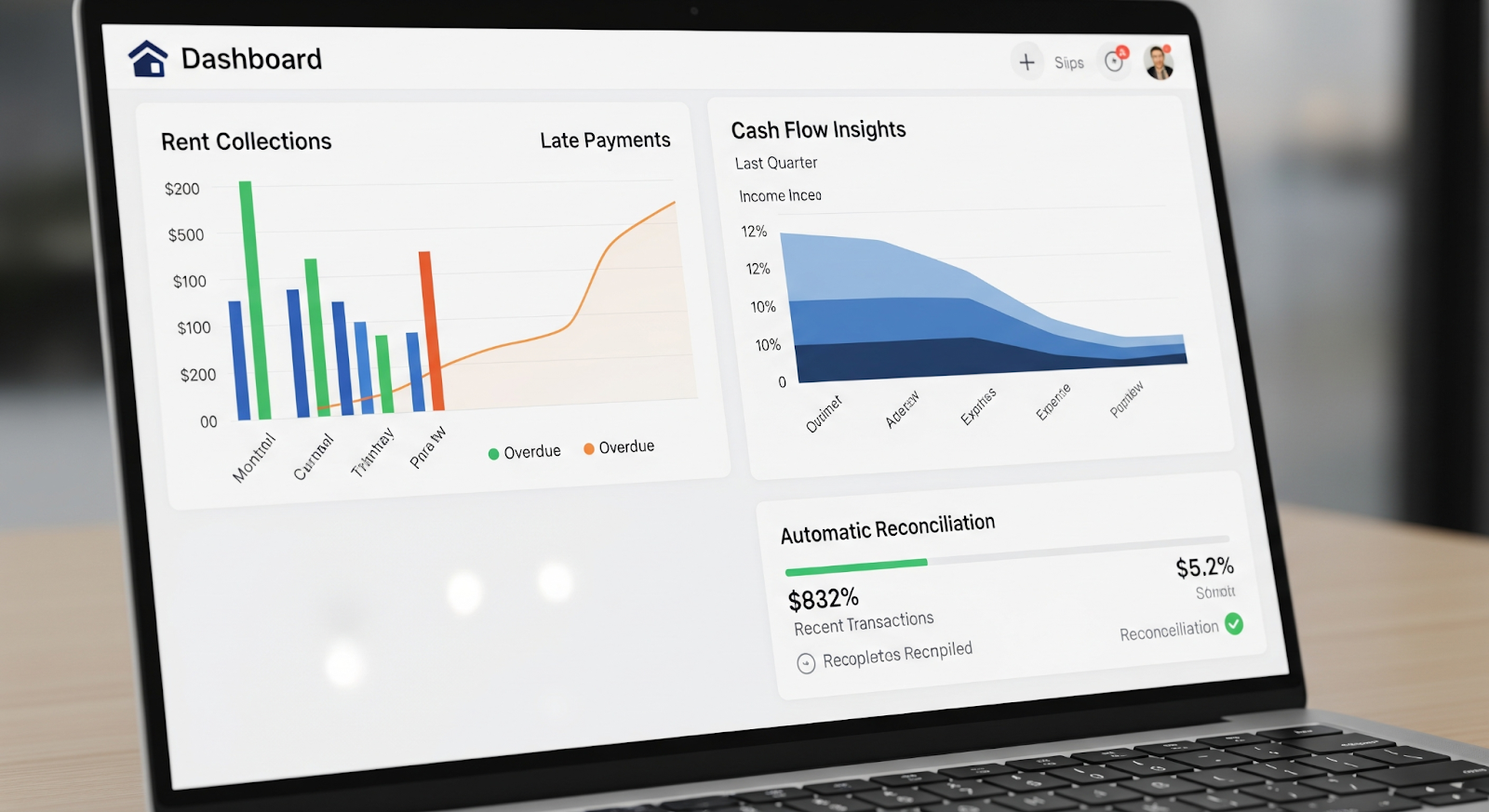

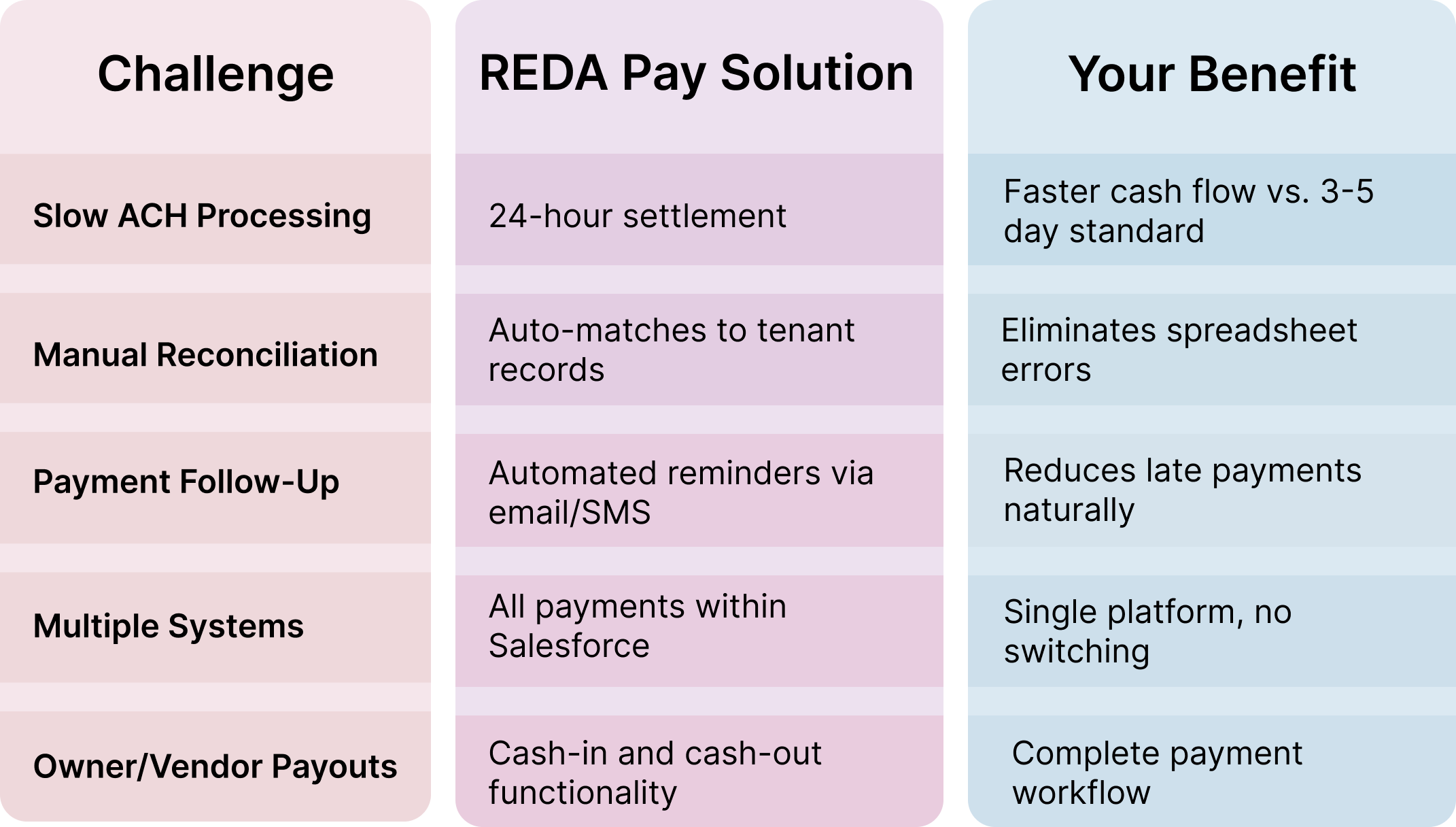

REDA Pay is built natively on Salesforce specifically for real estate professionals tired of payment headaches:

What this means: Instead of chasing payments and reconciling spreadsheets, you get predictable cash flow and time back for activities that actually grow your business.

JWB Real Estate Capital implemented REDA Pay across their portfolio and eliminated $50,000+ in annual manual processing costs while recovering 42+ hours monthly previously lost to payment administration.

Their CFO told me: "This was the fastest ROI we've seen on any operational investment. We finally have our weekends back, and our cash flow is predictable again."

The difference: JWB went from spending entire afternoons chasing payments to having complete visibility and control - all within the Salesforce environment they already use for everything else.

Late rent isn't just operational hassle - it's a direct threat to your NOI and investor relationships. Every delayed payment means lost interest, strained owner relationships, and tighter margins.

With rising costs and climbing rents, you can't afford to let cash sit idle in slow payment pipelines or waste time chasing tenants month after month.

REDA Pay changes the equation. Built natively on Salesforce, it delivers next-day rent deposits, automated reconciliation, and seamless payouts - ensuring you get your money on time, every time.

Don't let another month of late payments chip away at your portfolio's performance. Property managers who implement automated payment solutions first gain significant competitive advantages over those stuck in manual processes.

Schedule a 15-minute demo this week to see exactly how REDA Pay eliminates payment headaches within your existing Salesforce workflow. You'll see live demonstrations of 24-hour settlement, automated reconciliation, and streamlined tenant communication.

“Your investors are counting on consistent NOI performance. Give them the predictable cash flow they expect - and give yourself the operational freedom you deserve.”

.jpg)

.avif)

.png)

.png)